Rising Interest Rates - Should You Invest in Stocks?

Introduction

Global inflation is rising and has become a source of frustration as policy makers struggle with sluggish economic development and escalating costs.

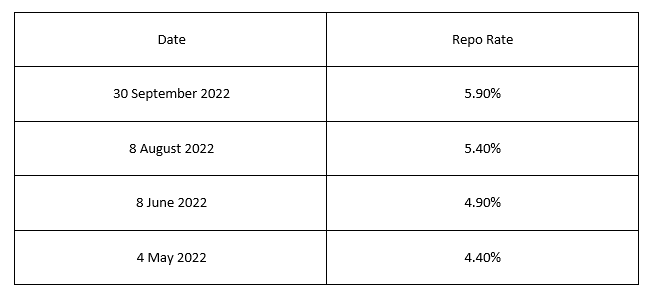

To combat inflation, the MPC (Monetary Policy Committee) raised repo rates by 50 basis points (bps), on September 30, taking it to 5.90% while retaining the inflation prediction for FY23 to 6.7%.

However, this year, Indian equity indexes have outperformed their international counterparts and are presently trading close to all-time highs. The US and European markets have been hampered simultaneously by worries of a recession and excessive inflation reaching 40-year highs.

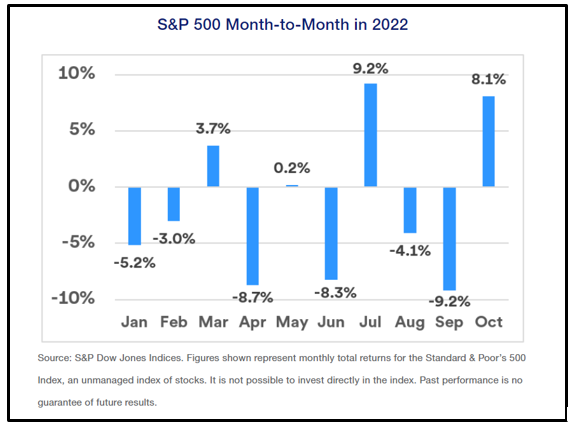

While the Nifty 50 index has increased by approx 3% year-to-date (Y-T-D), the Dow Jones index has fallen by 7%, the tech-heavy Nasdaq has plunged by more than 29%, and the broader S&P 500 index is down by 17%.

With so much volatility going around, investors have one question in mind – should we invest in stocks? This article will discuss the implications of rising interest rates for you as an investor and how you need to proceed with your investments during this period.

Rising inflation, interest rates, and bond yields: The Vicious Cycle

Worldwide inflation has been entrenched due to Russia’s invasion of Ukraine.

Prices increased last year due to supply chain bottlenecks, Covid-19-related shutdowns, and rising energy costs—problems predicted to disappear in 2022.

With these inflationary pressures going around, world economies had to increase interest rates, which caused the bond yields to rise and the stock market to fall.

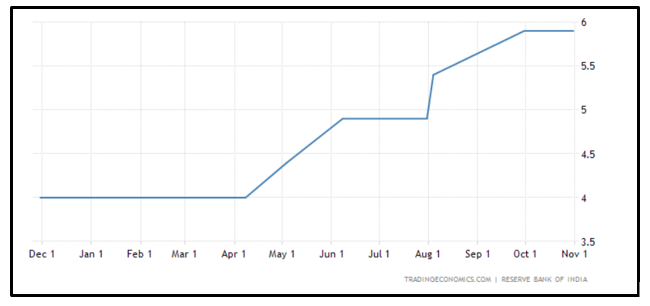

The RBI increased its benchmark repo rate by 50 basis points to 5.9% during its September meeting, marking the fourth successive rate increase.

Source: RBI

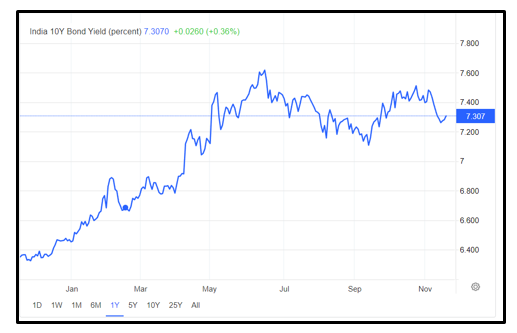

The rising interest rates have also caused an increase in bond yields. On November 10, 2022, India’s 7.26% 2032 bond yield dropped to 7.33%, its lowest level in six weeks.

Since January 2022, the bond yield has increased due to surging inflation and geopolitical pressures.

Source: Trading Economics

How can rising interest rates impact the stock market?

Banks are forced to increase their lending rates due to the rise in interest rates brought on by inflation. This increase in lending rates raises the cost of financing for businesses and organisations, which has an even more significant effect on the company’s financial health.

The Government’s 10-year bond yield is a proxy for debt service costs. Therefore, it seems sensible that the cost of capital would grow as yields rose. This further reduces returns, rendering stocks unappealing.

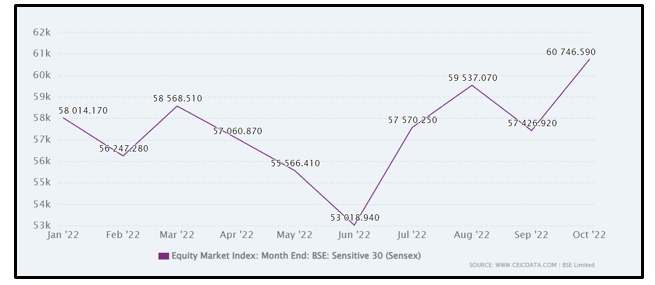

The stock market in India has been in a turbulent situation for most of 2022 due to increasing inflation.

Source: CEICDATA

inflation.

Source: U.S. Bank

In light of rising interest rates, what should investors do?

Rising interest rates will impact both the debt and equity markets. However, trying to predict where the stock market will go next when investing in equities is something one must avoid doing at all costs.

Maintaining portfolio diversification is essential, as is asset allocation. Investors can also continually do SIPs.

If you are willing to do goal-based SIP investing, choose Perpetual Wealth Management. We at Perpetual Wealth Management will assist you in determining each goal’s unique cost and time frame for completion.

Moreover, investors must decide which investments are the most suitable for rising interest rates. Increasing interest rates may be detrimental to some sectors but will only affect others a little. To benefit, investors can invest in these sectors and amend their portfolios.

Which sectors are the best to invest in when inflation is high?

1. Financial stocks

Banks, NBFCs, and insurance providers are examples of financial stocks. In general, interest rates benefit the financial industry as a whole, with the bank and NBFC stocks benefiting the most from an increase in rates. This is because they can demand more interest for their loan products.

2. Energy stocks or commodity stocks

Energy is considered a crucial component of inflation indexes; hence energy companies often perform better during high inflation periods. When there is strong inflation, oil and gas firms often fare well.

Moreover, commodity stocks, such as metals and agricultural commodities, can also benefit from inflation.

3. Healthcare

The healthcare sector is recession-resistant and is likely to be in demand forever, just like the other sectors on this list. Most customers would cut back on other discretionary items before healthcare costs, providing this industry with an advantage during rising inflation.

4. REITs

Generally speaking, REITs follow the direction of interest rates, increasing when they go up and decreasing when they go down.

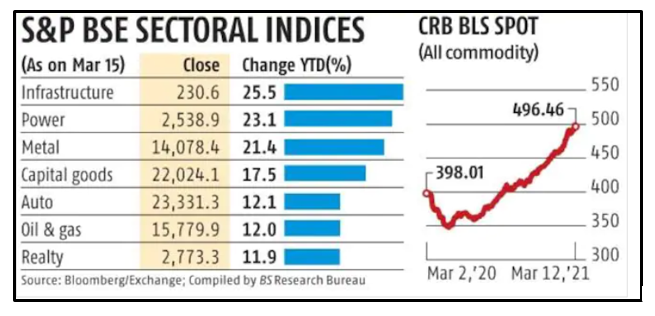

Below we can see how different sectors performed in the last financial year (FY21-22)

The healthcare sector is recession-resistant and is likely to be in demand forever, just like the other sectors on this list. Most customers would cut back on other discretionary items before healthcare costs, providing this industry with an advantage during rising inflation.

Source: Business Standard

So, investors can look for shares in these sectors and thoroughly do their fundamental research before investing.

To achieve their financial pursuits, investors can choose Perpetual Wealth Management. Our main goal is to invest clients’ money in reputable companies that continuously generate a profit in line with market circumstances. Our stock recommendations and methods are set up to provide clients’ portfolios with long-term returns and sustainable growth.

Building a resilient portfolio

Investors’ investment journey will undoubtedly include periods of high-interest rates. Building a portfolio that enables them to manage the volatility that rising rates bring about is the key.

When building a portfolio, consider the following points:

1. Diversify your holdings

Investors must ensure that they have a diverse portfolio of assets. By doing this, they will ensure that they have alternative investments in case one industry struggles.

2. Know your investing goals

It will be easier for investors to survive a declining market if they understand why they are investing. For this, investors can understand whether they need to invest for the long-term, short-term or medium-term.

3. Choose quality over quantity

It is advisable that investors must select a few high-quality stocks over a large number of low-quality ones.

4. Monitor the portfolio

Maintain frequent portfolio monitoring and rebalancing as required. This will assist in staying on course and preventing unwise choices.

5. Keep sufficient cash in hand

Finally, having a little amount of cash set aside to invest in the market when it declines is always a good idea.

Conclusion

No one method works for everyone when it comes to investing. What works for one individual may not work for another. The most crucial thing is establishing a plan of action you are confident in and at ease with.

Moreover, when selecting a stock for your portfolio, do thorough research.