Rematerialization is the exact opposite of dematerialization. Some investors may want to convert their electronic shares back into the physical form due to some reasons. Rematerialization is the process through which investors can get their electronic shares reconverted to physical certificates. You can opt to rematerialise your shares anytime you want. The process is completed within 30 days. However, rematerialized shares are illiquid as they cannot be traded.

Dematerialization and Its Process

About Dematerialization

The number of individual investors in the capital markets has been rising at a rapid pace in India. Individual investors make up for around 38% of the total volumes of the Indian equity markets. A large number of new investors are coming from small cities and towns, in contrast to the earlier trend of participants largely from metropolitan cities. The advent of digital technologies and electronic trading has played an important role in improving access to the capital markets. An investor sitting in any part of the country can invest in a variety of products ranging from stocks and bonds to exchange-traded funds.

Things were not so simple two and a half decades ago. Physical certificates were issued to record every investment and investors had to keep it safe to claim ownership. In the earlier era, open trading used to take place in the stock markets. Investors used to shout buy and sell orders and were issued paper receipts to record the transaction. Additional paperwork was required to properly record the beneficiaries after the closure of the market. The paper-based mechanism was time-taking, cumbersome and prone to errors.

With the aim to simplify the process and make it convenient for the investors, the Securities and Exchange Board of India introduced the electronic book-keeping of shares. To electronically record the movement of shares, the trading has to be electronic and the physical shares have to be converted into an electronic form. The entire system for electronic book-keeping and trading of shares was set up in India through the Depositories Act, 1996. The Depositories Act led to consequential amendments in various other laws such as the Indian Stamp Act, 1899, the Companies Act, 1956, the Securities and Exchange Board of India Act, 1992, the Income-tax Act, 1961 and the Benami Transactions (Prohibition) Act, 1988.

The Depositories Act was passed with an aim to make transferability of shares and other securities free, fast, safe and convenient. It led to the establishment of depositories and the dematerialization of shares. Dematerialization is the conversion of physical certificates into an electronic form to enable electronic trading. Depositories are the entities tasked with the storage of dematerialized securities as unlike physical securities, electronic shares cannot be stored in lockers. Depositories provide virtual lockers to investors, which is used to store their respective securities.

Dematerialization Process

To understand the process of dematerialization, you will have to know about the entities involved in the system. The four primary parties in the system are depository, the issuer or the company issuing the shares, the beneficial owner or the investor and the depository participant or the brokerage firms.

The depository is tasked with the storage of the dematerialized shares. There are two depositories in India— National Securities Depository Limited (NSDL) and Central Securities Depository Limited (CDSL). The issuer is the company that floats the shares or it could be any other entity that issues securities in any form. The depository participant is a SEBI-registered entity that is essentially an intermediary between the investor and the depository. Investors avail depository services only through depository agents.

The entire process of dematerialization takes place at different levels. The most important part is the dematerialization of shares at the investors’ level, but let us also take a look at other processes that lead to dematerialization. Issuers or companies are an important part of the system and they have to follow a set of rules to get the shares dematerialized.

- To begin the process of dematerialization, a company has to revise its Article of Association through a special resolution in the general meeting of the company, allowing it to issue shares in the electronic form.

- After the amendment in the Article of Association, the issuer has to register with the depositories. Private companies in India have to register with both NSDL and CDSL. The depositories have their own set of criteria for registration and the issuer has to comply with them. Post successful registration, the depositories provide a unique International Securities Identification Number for each of the shares. An ISIN is a 12 digit code that is used to identify different securities such as shares, debentures, bonds, etc. The first two digits of the ISIN indicate the country of origin of the securities and hence ISIN in India starts with ‘IN’.

- Just like investors, companies too get access to depository services only through an intermediary. If the issuer wants to transfer the dematerialized shares, it has to arrange for demat connectivity from depositories. Registrar and Transfer Agents act as an intermediary between the depository and the issuer. The company, the registrar and the depository enter into a tripartite agreement for different depository services like dematerialization, rematerialization and initial public offerings.

A similar arrangement has been put in place to provide depository services to investors. The depositories enter into an agreement with one or more participants. Any person can enter into an agreement with a depository for the storage of securities, but only through a depository participant. Along with brokerage firms, depository participants include insurance companies, banks stock exchange clearing cells, institutional managers, financial institutions and the Reserve Bank of India. Investors also have to follow a set of rules to convert their physical certificates into dematerialized shares.

Benefits of Dematerialization

Dematerialization of securities was a monumental reform in India. It changed the dynamics of the capital markets and led to an increase in the number of retail investors. Safety, convenience and ease of access are of the biggest benefits of dematerialization. Let us take a detailed look at the benefits of dematerialization.

- Safety: The conversion of physical certificates into electronic shares boosted the safety of the holding. Dematerialization eliminated the chances of shares getting lost or misplaced. Share certificates were also susceptible to theft and investors had to protect them like other physical assets. Dematerialized shares are stored in secure depositories, which has made theft a thing of the past. One of the other benefits of dematerialization is that it has eliminated the chances of forgery.

- Convenience: The dematerialization of shares gave a substantial boost to investor convenience. The transfer of shares used to take months to complete before dematerialization. Investors had to send the physical certificates to companies or registrars to get the name changed on the securities. It was a tedious process and used to take months. With a demat account, shares can be easily transferred and it takes just a couple of days to transfer ownership. Dematerialization had a similar impact on the process of changing the address of the investor. Earlier, investors had to fill out an application and send it to the companies for a change of address. Now, you just have to update your details with the depository participant and the address is updated in the company’s records.

- Cost-efficiency: Electronic trading doesn’t require cumbersome paperwork which automatically reduces a lot of expenses. Besides indirect cost savings, dematerialization led to the elimination of stamp duty, leading to a direct reduction in costs.

- Flexibility: One of the benefits of dematerialization is that it has led to increased flexibility and hence improved access for small investors. To simplify the calculation, shares were only traded in even lots before dematerialization. After the introduction of electronic trading, you can buy or sell even a single share without any restriction on the numbers.

What is Rematerialization?

Difference between Dematerialization and Re-materialization

Dematerialization is the conversion of physical shares into electronic shares while re-materialization is the opposite. Some of the key differences between dematerialization and re-materialization are in the process of execution, storage and costs. Dematerialized shares have unique ISIN while rematerialized shares have distinct numbers issued by the registrar and transfer agent.

- The transaction of dematerialized shares takes place electronically, but rematerialized shares have to be traded physically. As per the latest SEBI norms, rematerialized shares cannot be traded.

- Dematerialized shares are maintained by depositories, while rematerialized shares are maintained by respective companies.

- Since electronic shares are stored in secure depositories through depository participants, investors are required to pay the maintenance charges. The annual charges range in between Rs 500 to Rs 1000. Rematerialized shares or physical shares are stored by individual investors and no maintenance charges have to be paid.

- One of the most significant differences between dematerialization and re-materialization is the safety of the securities. The threat of theft is relatively lower in the case of dematerialized shares, while it is easier to forge or steal physical certificates.

How Dematerialization and Re-materialization of Securities Happen?

The process of dematerialization and re-materialization is largely similar, with some important differences.

- The transaction of dematerialized shares takes place electronically, but rematerialized shares have to be traded physically. As per the latest SEBI norms, rematerialized shares cannot be traded.

- Dematerialized shares are maintained by depositories, while rematerialized shares are maintained by respective companies.

- Since electronic shares are stored in secure depositories through depository participants, investors are required to pay the maintenance charges. The annual charges range in between Rs 500 to Rs 1000. Rematerialized shares or physical shares are stored by individual investors and no maintenance charges have to be paid.

- One of the most significant differences between dematerialization and re-materialization is the safety of the securities. The threat of theft is relatively lower in the case of dematerialized shares, while it is easier to forge or steal physical certificates.

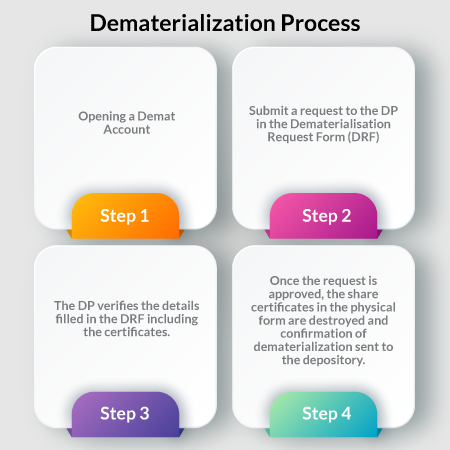

- To initiate the process of dematerialization, you will have to open a demat account through a depository participant.

- After opening a demat account, a dematerialization request form has to be filled and submitted to the depository participant with the physical certificates. Mention ‘Surrendered for Dematerialization’ on all the security certificates.

- After the submission of the form and certificates, the DP verifies the details and forwards the form to the company and the registrars through the depository.

- Post-approval, the physical certificates are destroyed and the exact amount of electronic shares are credited in the demat account.

- The shares are credited in the demat account of the investor after receiving confirmation from the depository.

- The entire process is completed in 15-30 days.

If you have dematerialized shares and want to convert it into physical shares, you will have to opt for re-materialization.

- To convert dematerialized shares into physical certificates, you will have to fill a remat request form and submit it to the depository participant.

- On receiving the form, the DP verifies the details and if everything is found in order, the DP issues an acknowledgement slip with stamp and sign.

- After the verification of details, the DP intimates the depository about the re-materialization request. The DP enters the request in software and a Re-materialization request Number is generated.

- The depository forwards the request with the documents to the registrar and transfer agent of the company.

- After receiving all the documents from the depository, the registrar verifies all the details. In case of any discrepancies, the registrar will demand its rectification and forward the request to the DP.

- If all the details are found correct, the registrar and transfer agent informs the depository and proceeds to print the certificates.

- The registrar sends the physical certificates to the client. Post conversion, the shares are allotted distinct numbers by the registrar and transfer agent.

- The depository on receiving the confirmation, informs the DP. The DP informs the investor and updates the account. The entire process is completed in 30 days.

Frequently Asked Questions Expand All

International Securities Identification Number or ISIN is a 12-digit alpha-numeric identification number assigned to securities. It is essential for electronic trading of securities and investors have to quote the ISIN number for actions like transfer of securities.

In a departure from earlier practices, dematerialization has enabled the trading of odd as well as even number of shares. Similarly, you can choose to dematerialize any number of shares.

IIFL is a full-service broker and provides high-quality research and other financial data to investors. Discount brokers just provide buying and selling services.