2. Perpetual Wealth Management - Insights

Investing in Mutual Funds

Planning for education

Investing vs borrowing for education

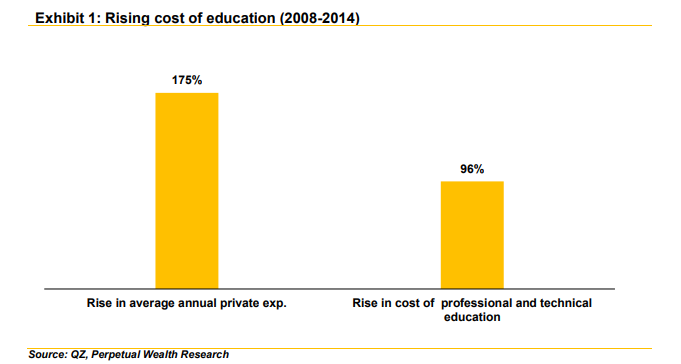

We all are aware about the rising cost of education in our country. The growth in cost of education is higher for higher education and a bit lower for schooling. Currently, higher education comprises of 60% of the market whereas schooling comprises of the rest i.e. 40%. According to national sample survey office (NSSO), between 2008 and 2014, the average annual private expenditure for general education (primary level to post graduation and above) shot up by a staggering 175% while during the same period, the annual cost of professional and technical education increased by 96%.

The expenses include course fees, books, transportation, coaching and related costs. The cost of education in private institutions in 2014 was about 11 times that in government schools, while the cost of higher education from a private institution is about 3 times that in one run by the government. According estimates, on an annual basis the education inflation is about 10-12%. This is compared to the broadline inflation which has come down to an average of 5-6%.

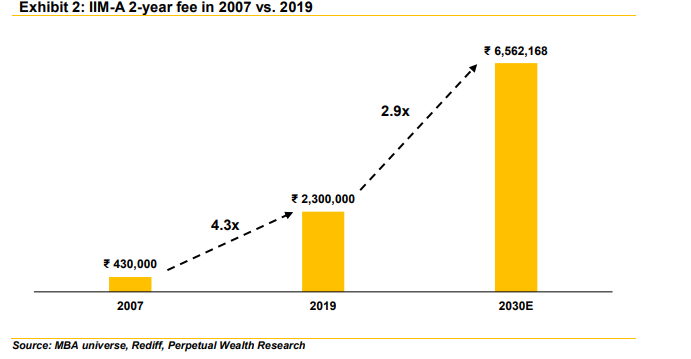

The class of 2019 of IIM-Ahmedabad will pay Rs 23.0 lakh for the two-year course, this is 400% higher than what it cost in 2007. If the fees continue to rise at 20% every year, it will cost roughly 95 lakhs in 2025. However, we believe post RBI targeting headline inflation to be close to 4% (+- 2%) education inflation may come down to 10%. January 2019 education inflation was close to 8.4%. Using, 10% inflation IIM-A 2-year fee may come close to 65.6 lacs in 2030.

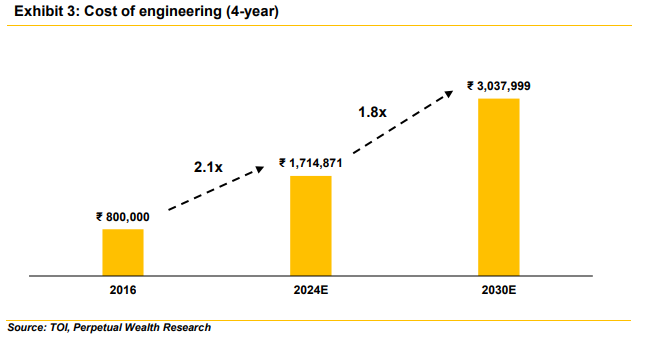

Similarly, at an average inflation rate of 10%, a four-year engineering course that costs Rs 8 lakh in 2016 is likely to cost Rs 17 lakhs in 8 years and Rs 30 lakhs in 2030. For engineering and medical aspirants, the costs start even while the student is in school as most children need to join coaching institutes, which cost Rs 80,000 to Rs 1,00,000 a year.

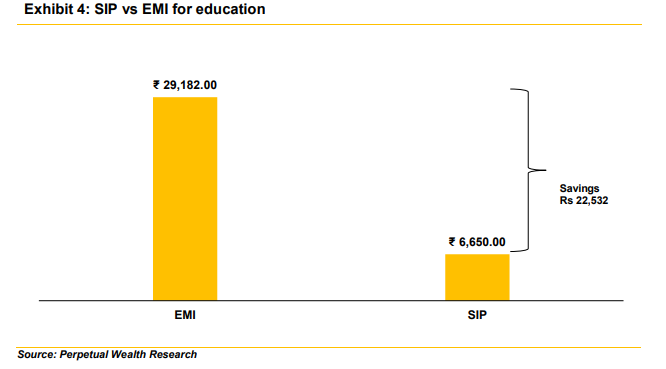

We at Perpetual Wealth Management (PWM) believe that provisions for this expected higher cost of education needs to be done since the early age of a child as it eases the pressure for their parents in the future. Obviously, there are other options like taking a loan in the future, however, we believe it would be wiser to use loans to bridge the gap between the actual expenditure and the accumulated savings rather than taking a loan for a major portion of the education cost. To demonstrate the difference – let’s assume there is a child who is 5 years old. If parents are planning to save Rs 25,00,000 for the child’s education until he/she turns 18 then the monthly SIP (assuming 12% IRR) comes to ~Rs 6,650/- where as if a parent takes a loan of a similar amount the EMI (assuming 10.5% for SBI education loan above 7.5 lakhs for 13 years) would be ~Rs

29,182/-. Hence, by planning early parents can save monthly cash flow of Rs 22,532/- in the

future.

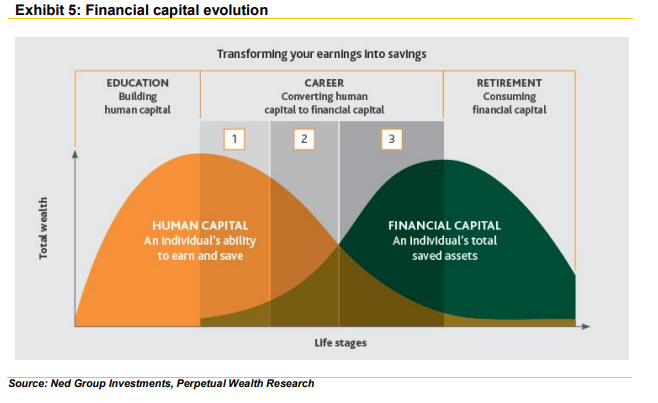

As observed in the life stages of financial capital, a person is mostly in the accumulation phase of financial capital during the time their child is growing up and we believe it is easier for someone to save during this period rather than paying (either parent or child) back loans in the future. It results in significant savings and eases pressure for both parent and child in the future.

CONCLUSION:

Hence, in conclusion we can say that it is wiser in terms of financial savings for an individual to plan for a child’s education early rather than paying loans later. It is much better to have zero or low liabilities close to later stages of life when an individual enters the consumption and distribution phase of financial capital.