If you’re a non-resident Indian, you can also choose to open a non-repatriable account. This type of account does not allow you to transfer funds abroad. It needs to be linked to a Non-resident Ordinary (NRO) bank account.

Demat Account

A Demat account is primarily used to electronically hold securities and shares. The concept was first introduced in the country in the year 1996 as an alternative to physical share certificates. A Demat account not only makes share trading quick and easy, but also eliminates all of the risks and problems associated with physical share certificates. You can use a Demat account to store a wide variety of investments such as equity shares, ETFs, bonds, debt securities, mutual funds, and government securities among others. In India, possession of a Demat account is mandatory if you wish to invest in the stock market.

What is a Demat Account?

A Demat account is also known as Dematerialized account. In other words, converting or dematerializing your physical shares in the electronic format is known as holding a Demat Account. Demat account is used to hold the shares and securities of publicly traded companies in an electronic form. With a Demat account, you can hold a wide variety of investments such as bonds, equity shares, government securities, mutual funds, and exchange traded funds. Similar to a bank account, a Demat account is either credited or debited each time you buy or sell shares of a company.

It not only eliminates unnecessary paperwork, but also helps streamline the process of share trading. All of the Demat accounts in India are maintained by two organizations, namely National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

TABLE OF CONTENT

Dematerialization: What Does it Mean?

In the initial days of the stock market, shares were held in a physical form by way of share certificates. However, it made the entire process of share trading cumbersome and difficult to carry out at short notice. There were also issues of share certificates being fakes or forged. Certificates were also often lost or physically damaged.

In order to eliminate these limitations and problems associated with physical shares, the National Securities Depository Limited (NSDL) was established in the year 1996. NSDL brought in the concept of Demat accounts, which could be used to electronically store shares and securities of companies. If you own physical shares, you need to convert them to electronic records before being able to use a Demat account. This process of conversion is what is commonly known as dematerialization.

Explaining the Dematerialization Process

The process of dematerialization is simple and requires very little effort from your part. By following the steps below, you can easily convert your physical shares into electronic form.

- Firstly, you’re required to open a Demat account with a depository participant (DP) like IIFL. A depository participant is an entity that acts as an intermediary between you and the depository (either NSDL or CDSL).

- Once your Demat account is active, you need to send a duly filled Demat Request Form (DRF) along with your physical share certificates to your depository participant.

- Your depository participant will then process your request by sending your share certificates back to the company.

- In addition to this, your DP will also send a request to the company’s appointed Registrar and Share Transfer Agent (RTA) via the depository.

- Upon approval of the request, the share certificates are destroyed by the company and a dematerialization confirmation is sent to the depository.

- The depository relays the dematerialization confirmation to your depository participant and subsequently credits your Demat account with the relevant number of shares.

Depositories and Depository Participants

A depository is an organization or an entity that helps store financial assets electronically, so traders and investors can buy, sell, or hold them. In India, there are two depositories that are responsible for maintaining all of the Demat accounts in the country. These are:

- National Securities Depository Limited (NSDL)

- Central Depository Services Limited (CDSL)

However, you can only deal with a depository through a depository participant (DP) such as India Infoline. A depository participant essentially acts as an intermediary between you and the depository. If you hold any physical shares, you will first need to convert them into electronic records before you can use a Demat account. This conversion process is commonly known as ‘dematerialization.’

How does Demat Account Work?

Buying of stocks in the share market can be done only through a trading account. Meanwhile, a Demat account is used to hold the shares bought through the trading account. Therefore, in order to realize the full potential of a Demat account, it is imperative to link it with a trading account. The following process will show you exactly how a Demat account works.

- When you place an order, say a ‘buy’ order, on your trading platform, a ‘buy’ request is forwarded by your depository participant to the stock exchange.

- The stock exchange then matches your ‘buy’ request with a similar ‘sell’ request and sends an order to the clearance houses.

- The clearance houses then settle the trade by debiting the specific number of shares from the seller’s Demat account and crediting it to your account at the close of the share market.

Demat Account – Features & Benefits

Features of Demat Account:

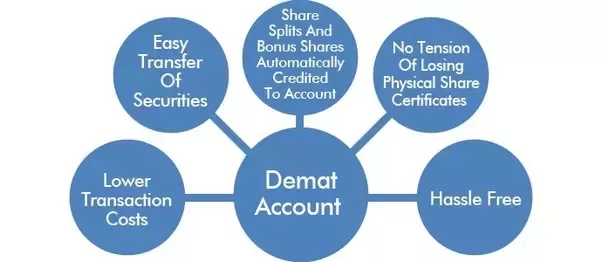

By opening a Demat account, you enjoy access to a number of useful features. Here are some of the most important ones.

- Share transfer: Transferring your shares is extremely easy with a Demat account. You only need to send in a duly signed Delivery Instruction Slip (DIS) to your depository participant to transfer your shares.

- Loan collateral: You can pledge the securities you hold in a Demat account and use them as collateral for securing a loan from a financial institution.

- Temporary freeze: You can temporarily freeze your Demat account for a specific duration. However, this feature is generally only made available if you hold a specific number of shares in your account.

- Quick transfer of benefits: Best Demat accounts offer a swift transfer of benefits such as dividends, bonus issue of shares, stock splits, interest, and refunds.

- Speed e-facility: NSDL allows you to send instruction slips to your depository participant electronically. This not only makes the entire process faster, but also makes it less cumbersome.

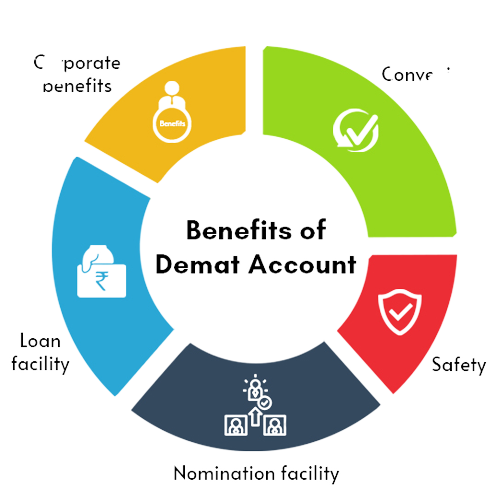

Benefits of a Demat Account

In addition to being an indispensable part of the share market, best Demat accounts come with several benefits such as

- Swift settlements and deliveries

- Increases share trading volume and market participation

- Increases transparency

- Eliminates paperwork

- Quick and easy communication with investors

- Little to no risks involved

- Builds trust and increases investor confidence

Types of Demat accounts

In India, there are primarily three types of Demat accounts offered by depository participants. Depending on your residential status, you can choose the right kind of account for your share trading and investment purposes.

The different types of Demat accounts are further explained below:

Regular Demat accounts:

These are dematerialized accounts for residents of India. If you’re an India resident primarily dealing with equity trading and investment, you’ll find the regular Demat account ideal.

Repatriable Demat accounts:

This is one of the two types of Demat accounts available for non-resident Indians. As its name signifies, a repatriable account allows you to transfer your funds abroad if you’re an NRI. You need to link this account with a Non-resident External (NRE) bank account to enjoy repatriation of your funds

Non-repatriable Demat accounts:

Opening Demat Account

Tips to Choose the Best Demat Account for You

Check whether the account maintenance charges are economical

Maintenance of Demat accounts involves annual charges irrespective of whether you make transactions or not. Other charges are applicable too. You must, therefore, check out the range of charges involved with the Demat account and choose the most economical account.

Enquire about the account opening process

The Demat account opening process offered by your DP should be hassle-free and quick. Opening a Demat account involves a detailed process as per SEBI guidelines. The depository participant can, nevertheless, simplify it with the help of e-KYC.

Look for a seamless interface for broking and banking

Depository participants also offer Demat accounts that serve as trading accounts too, thus providing seamless transfer of money during sale or purchase of shares and securities. An interface between the two accounts not only simplifies transactions but also makes them economical.

Check if the DP offers customised analytics for Demat account holdings

Online analytics customised as per your choice of shares and security along with their investment habits allows you to increase earnings. You must look for value additions like these when choosing the best Demat account.

Additionally, features like a shorter turnaround time (TAT) for share dematerialisation allow you to assess the DP’s commitment towards serving investors.

The Advantages of Choosing India Infoline

- IIFL’s financial products and services have enriched the lives of over 4 million customers.

- India Infoline is a leading broker in the financial services industry.

- At the heart of IIFL is an award-winning research team.

- The solutions offered by IIFL are backed by world-class technological platforms.

- A dedicated support team ensures that IIFL’s customers receive top-class assistance.

- Through a single Demat account opened with IIFL, you can invest in various options such as IPOs, derivatives, equities, commodities, and more..

- India Infoline also offers you daily and weekly reports customized exclusively for you.

- The IIFL Stock Trading app is a user-friendly tool that allows you to trade from anywhere, anytime.

Demat Account Glossary

If you’re a first-time investor or trader, you may chance upon some unfamiliar terms and phrases related to Demat accounts. Here’s a Demat account glossary that can help make the fundamentals clearer.

Bull market:

In a bull market, the prices of assets show an upward trend. The financial markets are typically bullish in an economy that shows signs of growth and development. It’s generally a good move to purchase shares in a bullish market.

Bear market:

A bearish market shows signs of decline. The prices of assets display downward trends consistently. When the market is bearish, you may find that you’re inclined to sell off your assets.

Dividend:

Many listed companies pay a part of their profits to shareholders. This is known as dividend. By investing in the right companies, you could earn dividends that act as a supplementary source of income.

EPS:

Earnings Per Share (EPS) is a financial ratio that you obtain by dividing a company’s profit by the number of shares it has. Analysing parameters like the EPS can help you understand a company’s financial health, so you can make better investment decisions.

Depository:

A depository is an entity that holds your financial assets in a dematerialized form. You can buy or sell securities with the help of a depository. Furthermore, depositories also keep a record of all your trades.

Depository participant (DP):

A depository participant is the link between the depository and the companies that issue stocks and other instruments. DPs can be banks, financial institutions, or brokerage houses. IIFL is a depository participant.

Day trading:

Day trading is essentially a practice wherein you buy and sell securities on the same day using your Demat account. It helps generate short-term income if your trades are successful.

Blue chip stocks:

These are equities of companies that have a proven track record of performing financially well. By investing in blue chip stocks for the long term, you can enjoy good returns in the form of dividends as well as profits.

Frequently Asked Questions Expand All

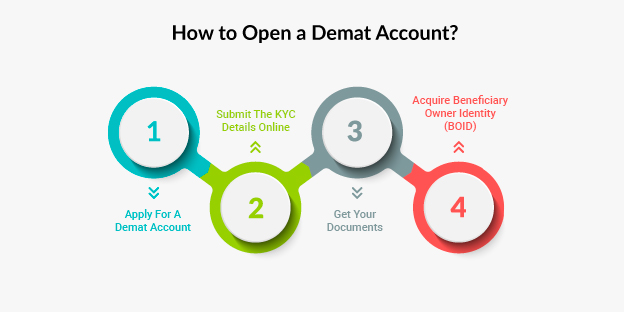

Opening a Demat account is a fairly straightforward process. Here’s a step-by-step guide.

- Fill the Demat account opening form.

- Submit the form along with the documents required.

- Your depository participant may require an in-person verification, wherein a representative of your DP may call you to verify the details you’ve submitted in the documents.

- Once the verification process is complete, the DP activates your Demat account.

To open a Demat account with a DP, you’ll need the following documents.

- A proof of identity, such as your PAN card, Aadhar card, voter’s ID, or driving license

- A proof of address, such as your passport, utility bills, or bank passbook

- A proof of income, such as your income tax return or salary slips

- A passport-sized photograph

On average, it takes around 7 to 14 days to have your Demat account opened and active.

Some DPs may require you pay account opening charges, while others may not. India Infoline does not charge any fees for opening a Demat account.

These are essentially annual charges levied by a depository participant for maintaining your Demat account. When you open a Demat account with India Infoline, you enjoy zero AMC for the first year. account.

A Demat account is created for the purpose of holding your financial assets in a dematerialized form, while a trading account helps you buy and sell shares and other commodities. You can link your Demat account and your trading account, so share trading becomes easier for you.

You’re eligible to hold multiple Demat accounts. The caveat is that you cannot open more than one Demat account with the same depository participant.

The following persons are eligible to open a Demat account in India.

- Resident individuals

- Non-resident individuals

- Hindu Undivided Families (HUFs)

- Partnership firms

- Companies

Yes, you can open a Demat account in the name of a minor child. However, this account needs to be operated by a parent or a guardian till the minor child comes of age.

India has two depositories that are registered with SEBI, namely:

- National Securities Depository Limited (NSDL)

- Central Depository Services (India) Limited (CDSL)