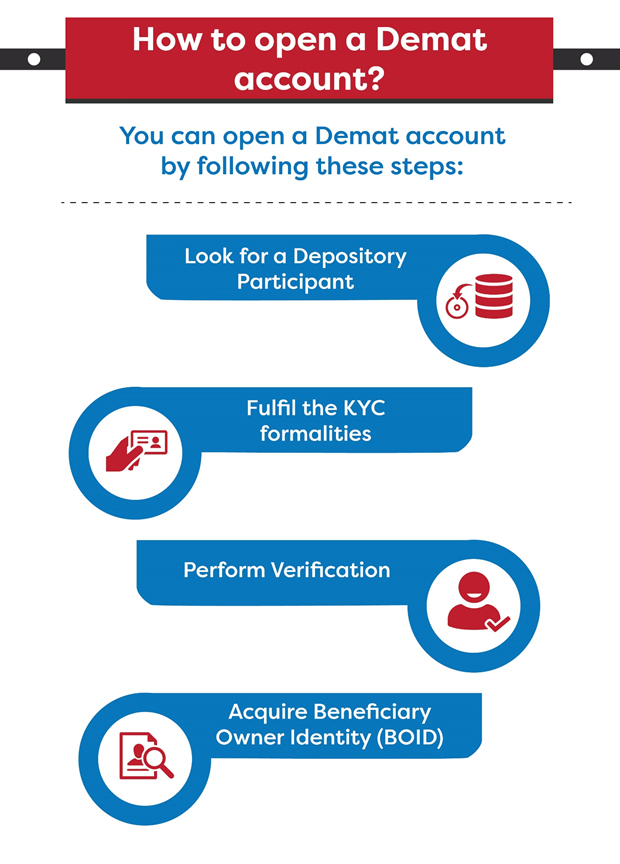

You need a demat account to hold your shares and securities in the electronic format. And opening an online demat account is a fairly straightforward process. To begin with, you need to select a depository participant (DP). DPs can be banks, financial institutions, brokers, or any other entities authorized by SEBI to act as an intermediary between you, the investor, and the depository.

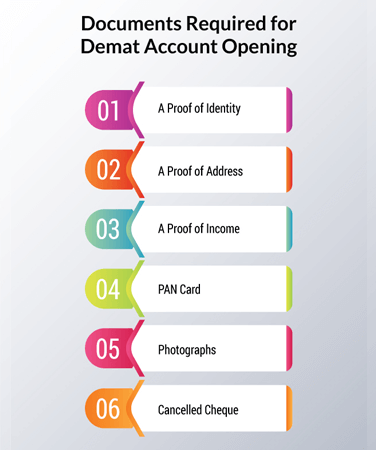

Before you begin the process of opening a demat account, you’ll need to look up the depository participant’s terms and regulations to understand the documents needed to get your account activated. Knowing the list of documents needed for an online demat account beforehand can help you be prepared for the account opening process. This, in turn, will help you get done with the application process quicker. Furthermore, having your documents in place can also make the approval process faster from DP’s end.